• An agreement to acquire Clean Earth, a leading US Hazardous Waste player with prime assets including 700 operating permits

• 2X size of Veolia US Hazardous Waste becoming the number 2 player1 in the US

• Increased exposure into fast growing industries such as retail & healthcare to offer full range of environmental services across the US

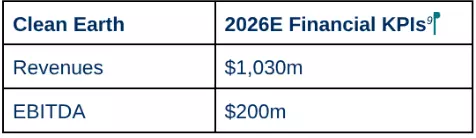

• $3bn valuation, 9.8x 2026e EBITDA2 post run-rate synergies. Accretive from year 2

• €2bn in asset disposals and portfolio transformation

• Veolia’s global Hazardous waste revenue to increase to €5.2bn, EBITDA margin to increase to 17%3

• Significant boost of Veolia’s anchoring in the United States and in Hazardous Waste activities, both identified as growth boosters in the GreenUp strategic plan

“In line with our GreenUp focus on growth boosters, this acquisition is a major step in the Group transformation and the strengthening of its financial profile. It allows us to unlock the full value potential of our US Hazardous Waste activities and to double our size on this critical fast growing sector, creating a number 2 player. We reinforce our global capacities in Hazardous Waste and further increase our international footprint. Thanks to a de-risked integration process and a strong complementarity between both businesses and teams, this transaction offers a solid value creation potential with significant synergies. It will also unlock a new growth potential for the Group by strengthening our exposure to the most dynamic industries across the U.S., and open up new opportunities for our diversified offerings nationwide. We also further accelerate our asset rotation strategy and portfolio pruning with an additional c.€2bn+ assets disposals in mature activities, leading to a total of €8.5bn of asset rotation since the launch of GreenUp. This continued transformation of our portfolio enhances the growth profile and strength of our Group, uniquely positioned to tackle the sustained demand for environmental security”, said Estelle Brachlianoff, Veolia’s Chief Executive Officer.

Veolia announces its biggest and most transformative acquisition since the merger with Suez both for its growth acceleration in the U.S. and for the U.S. Hazardous waste. The Group has entered into an agreement with Enviri to acquire Clean Earth, a prime asset in the U.S. hazardous waste sector. It will double Veolia’s US hazardous waste footprint to create a number two player in a fast growing sector, with a nationwide operational platform, wider market coverage and an advanced portfolio of technical capabilities. It will also enable Veolia to strengthen its presence in fast growing industries such as retail and healthcare allowing it to offer a full range of environmental services on a nationwide basis.

Clean Earth is acquired for an Enterprise Value of $3bn (or ~€2.6bn), representing 9.8x 2026e EBITDA4 post run rate synergies. The transaction offers strong value creation for shareholders with $120m of synergies by year 4, backed by Veolia’s solid track-record, and current EPS accretion from year 2. Upon the completion of the acquisition the Group’s Hazardous Waste revenue will reach €5.2bn with EBITDA margin of 17%5 and we enhance our financial ambition for our Hazardous Waste activities, now targeting EBITDA growth of at least 10%6 over 2024-27.

Fully aligned with its GreenUp program, the acquisition boosts Veolia’s growth ambitions in the U.S. and in the hazardous waste sector, where the Group has expanded through a series of recent acquisitions, with a proven track record of successful integration, and continues to advance the company’s broader US development goals. Overall, Veolia’s revenue in the U.S. will reach $6.3bn7, reinforcing its international footprint.

The Hazardous waste treatment sector is particularly robust, especially in the United States, where it is outperforming a challenging economic environment. It is an essential service for key industries, particularly those undergoing transformation or reshoring production, such as advanced manufacturing, semiconductors, clean-energy production, health care and pharmaceuticals, etc. These shifts are driving strong demand, growth opportunities, and underscoring the urgent need for effective treatment solutions, contributing to public health and environmental security.

With its 82 locations, including 19 EPA8 permitted Treatment, Storage and Disposal Facilities (TSDFs) and over 700 operating permits across the country, the Clean Earth portfolio is highly complementary to Veolia’s one. The combined entity will accelerate synergies and growth through greater efficiencies due to enhanced logistics and expanded treatment capabilities and technologies, including PFAS treatment and new contaminants. It also enables Veolia to further develop its business in underserved geographies like the Southeast and Pacific Northwest.

The move is fully aligned with the dynamics of the GreenUp strategic program, as Veolia has embarked on significant international expansion in key growth areas, pursuing both organic growth and acquisitions. It will also accelerate the transformation of the Group’s portfolio, which began two years ago, with c.€4bn of asset rotation in 2024 and 2025. With Clean Earth and the €2bn additional asset disposals we have decided, we will have achieved c.€8.5bn of asset rotation since the launch of GreenUp.

The financing of the transaction will be in line with Veolia’s disciplined financing policy and will be funded through the Group’s existing financial resources and debt. The Group remains committed to retaining its BBB / Baa1 investment grade rating with a target financial leverage around or slightly above 3x in 2026 and lower than or equal to 3x in 2027.

The transaction is aimed to close mid 2026, subject to the satisfaction of customary conditions to a transaction of this nature, including approval by Enviri’s shareholders and receipt of the necessary authorizations and regulatory approvals.

1 TSDFs owned by commercial operator

2 Adjusted and post IFRS 16

3 Proforma Veolia Hazardous Waste + Clean Earth 2025E

4 Adjusted and post IFRS 16

5 Proforma Veolia Hazardous Waste + Clean Earth 2025E

6 At constant forex

7 Proforma Veolia US + Clean Earth 2025E: $6.3bn revenue

8 Environmental Protection Agency

9 Adjusted and post IFRS 16

ABOUT VEOLIA

Veolia group aims to become the benchmark company for ecological transformation. Present on five continents with 215,000 employees, the Group designs and deploys useful, practical solutions for the management of water, waste and energy that are contributing to a radical turnaround of the current situation. Through its three complementary activities, Veolia helps to develop access to resources, to preserve available resources and to renew them. In 2024, the Veolia group provided 111 million inhabitants with drinking water and 98 million with sanitation, produced 42 million megawatt hours of energy and treated 65 million tonnes of waste. Veolia Environnement (Paris Euronext: VIE) achieved consolidated revenue of 44.7 billion euros in 2024.