Good Morning. This is the Sunya Scoop. The newsletter that takes energy transition news and turns it into an easy-to-read email for you.

Here’s what we have for you today:

What will have the greatest impact on global emissions reduction in the next decade? |

Results shown next week

Warren Buffett’s Berkshire Hathaway and West Virginia’s Republican lawmakers are collaborating on a solar-powered industrial project in an area heavily reliant on coal.

The project involves building a manufacturing hub with a $500 million factory for producing titanium using solar panels and rechargeable batteries.

Despite West Virginia’s strong coal industry ties, the project has gained support due to the promise of 300 jobs and federal incentives.

West Virginia has approved $400 million in funds for renewable-energy projects, including Berkshire’s, and passed legislation favorable to renewables.

The Biden administration’s federal incentives for clean energy are driving investments and job growth in Republican-leaning states.

Traditional coal industry influence is weakening as renewable energy gains traction due to economic development opportunities.

The project faced opposition from coal-centric areas, but it was aided by federal subsidies and economic benefits.

West Virginia’s emphasis on coal has hindered investment, but recent pro-solar legislation and incentives are changing the landscape.

Electricity from renewables is now cheaper than coal, but West Virginia lags behind in installed solar capacity.

The project is a partnership between Berkshire Hathaway’s subsidiaries, BHE Renewables and Precision Castparts, aiming to produce titanium using green energy sources.

Morgan Stanley Infrastructure Partners (MSIP) and Crowley collaborate on advancing offshore wind energy solutions in the U.S.

They create a joint venture, Crowley Wind Services Holdings, to combine Crowley’s maritime and logistics capabilities with MSIP’s financial strength.

MSIP, a private infrastructure fund platform within Morgan Stanley Investment Management (MSIM), will hold a majority stake in the joint venture.

Crowley will operate the business, focusing on repurposing and operating existing U.S. port facilities for offshore wind development.

The partnership aims to support manufacturing, assembly, storage of wind components, and maritime services for offshore wind installations.

The U.S. offshore wind industry aims to develop 30 GW of capacity by 2030 and 110 GW by 2050.

Crowley plans to construct the Salem Wind Services Terminal in Massachusetts and pursue a West Coast terminal in California.

The partnership aims to contribute to the growth of the wind energy sector and provide clean, renewable energy for the U.S.

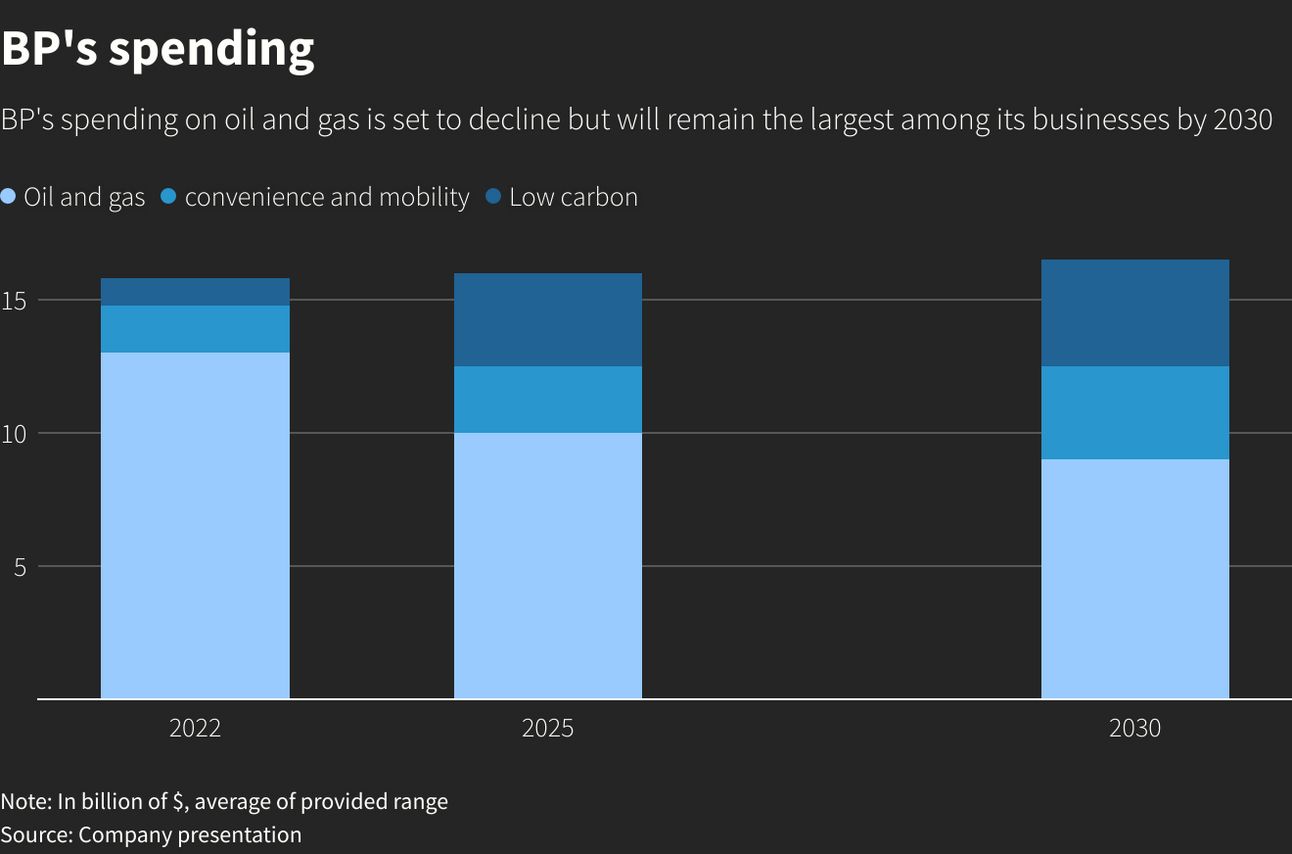

BP CEO Bernard Looney affirms commitment to the energy transition strategy despite investor concerns and share performance.

Looney, who took office in 2020, set ambitious goals for BP to achieve zero net emissions by 2050 and invest in renewables and low-carbon power.

Despite challenges like COVID-19, geopolitical issues, and energy price shocks, Looney maintains the transition plan.

Earlier this year, BP scaled back plans to cut hydrocarbon production by 2030 from 40% to 25% from 2019 levels.

Source: Reuters

BP remains the only major oil company aiming to reduce output by the end of the decade, compared to Shell and TotalEnergies planning to grow output.

BP’s shares have risen around 4% since Looney took office, lagging behind European counterparts and U.S. rivals.

Looney emphasizes holding the transition course, focusing on electric vehicles (EVs) for private transport.

BP plans to invest $55-65 billion in EV charging, biofuels, hydrogen, wind, and solar between 2023 and 2030.

Despite criticism of spending on low-carbon fuels, Looney believes in growth opportunities outside of traditional oil and gas sectors.

Transition businesses accounted for $700 million of $23 billion in core BP earnings in H1 2023, with expectations to grow significantly.

Looney acknowledges that it’s impossible to satisfy everyone but remains steadfast in the transition strategy.

The Biden administration announces a $12 billion package of grants and loans for auto makers and suppliers to retrofit plants for producing electric and advanced vehicles.

The goal is to support the transition to electric vehicles (EVs) while ensuring workers and communities are not left behind.

This move aims to address concerns from automakers and the United Auto Workers (UAW) union about proposed environmental regulations for the EV era.

The UAW, fearing job losses, welcomes the policy as it emphasizes strong union partnerships, high pay, and safety standards during the EV transition.

President Biden emphasizes the potential for a clean energy economy to benefit both auto companies and unionized workers.

The funding also aims to support domestic battery manufacturers, with $3.5 billion allocated for this purpose.

$2 billion in grants will come from the Inflation Reduction Act passed by Democrats, and $10 billion in loans will be provided by the Energy Department’s Loans Program Office.

While there are no specific labor requirements, projects with better labor conditions have a higher chance of receiving funding.

The package aims to address concerns about job losses due to the rapid transition to EVs, particularly in states with a strong automotive industry presence.

Albemarle is making a new offer to acquire Australia’s Liontown Resources for $4.25 billion in one of the largest-ever lithium deals.

The offer values Liontown at AUD 3 in cash per share, equivalent to $1.92, which Albemarle states is its best and final offer.

Liontown is developing a significant hard rock lithium deposit, making it a valuable asset in the lithium-mining industry.

The proposed deal is part of the ongoing transformation of the lithium sector due to the growing demand for batteries in electric vehicles and clean-energy technologies.

Albemarle’s pursuit of Liontown reflects a trend of increased deal-making in the lithium industry, with companies seeking to secure their supply chains for critical metals.

Other notable deals include Philadelphia-based Livent’s merger agreement with Australia’s Allkem to create an $11 billion lithium player and Exxon Mobil’s acquisition of rights to lithium acreage in Arkansas.

The lithium market has experienced significant growth, with sales worth $48 billion in 2022 compared to $1.6 billion in 2015, according to Benchmark Mineral Intelligence.

Despite the growth, lithium prices have been volatile, and companies face challenges with increasing costs and labor market constraints.

The stability of Australia’s regulatory system and established resources industry have made it the world’s top lithium producer, with potential for an integrated supply chain.

Albemarle already has mining and lithium-conversion plants in Australia and aims to capitalize on growing lithium demand driven by electric vehicles and other markets.

Lithium is a key component in EV batteries and other clean-energy technologies, playing a crucial role in the energy transition.

What’d ya think of today’s email? |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.